Albert Ezerzer Lucifer - What's The Real Story?

Have you ever typed something into a search bar, maybe a curious string of words like "albert ezerzer lucifer," and wondered what you might find? It's a rather intriguing combination, isn't it? Well, as a matter of fact, if you're looking for something that helps you get a good handle on your money matters, you might just stumble upon an incredibly useful tool called Albert. This isn't about some mysterious figure or ancient tale; it's about a very real, very practical way to make your financial life a bit smoother.

So, sometimes, what we search for can lead us to unexpected places, and in this particular instance, the name "Albert" points to a widely used digital assistant designed to give you more control over your personal finances. It’s a simple idea, really: put all your money stuff in one spot, making it easier to see where everything stands. This app has gathered quite a following, helping millions of people sort out their budgets, put money aside, keep an eye on their spending, and even put a little cash into investments.

You see, the whole point of this "Albert" is to simplify things that can often feel pretty complicated. It's like having a friendly helper right there on your phone, ready to assist with the daily ins and outs of your money. We're talking about a tool that nearly ten million individuals are already using today, which, you know, is quite a lot of people finding value in what it offers. It seems, in some respects, to be making a real difference for folks who want to feel more secure about their financial well-being.

- Olivia Milton John

- Is Rudy Pankow Getting Married

- Age Difference Between Kristin Chenoweth And Josh Bryant

- Aaron Rodgers Is He Married

- Rod Stewart Last Tour

Table of Contents

- What Is Albert and Why the Curious Phrase?

- Getting Your Start with Albert

- How Does Albert Help You Manage Your Money?

- Exploring Albert's Financial Offerings

- What Does Albert Cost, and Is It a Good Value?

- Is Albert a Bank? Clearing Up the Albert Ezerzer Lucifer Connection

- The Albert Community - Joining Millions of Users

- Keeping Tabs on Your Spending with Albert

What Is Albert and Why the Curious Phrase?

You might be wondering, "What exactly is this 'Albert' that keeps popping up when I look into things like 'albert ezerzer lucifer'?" Well, actually, Albert is a popular financial application, a tool that lives on your mobile device. Its main purpose is to put you in a better position when it comes to your money. It's a way to handle your budget, put funds aside for future needs, keep track of what you spend, and even make some investments, all from one place. It's really quite a strong and effective application, designed to give you a clearer picture of your financial situation.

So, the name "Albert" here refers to this helpful financial technology, not a person or any other concept that the phrase "ezerzer lucifer" might bring to mind. It's a digital assistant, if you will, that aims to simplify the often-tricky business of personal finance. Many people find managing their money to be a bit overwhelming, and this app tries to make that whole process a lot less stressful. It seems, in fact, to be working for a great many people.

Getting Your Start with Albert

If you're thinking about giving Albert a try, getting set up is pretty straightforward. You just need to get the application onto your mobile phone. You can find it easily enough in your device's app store, whether you use an Apple phone or an Android device. It's like downloading any other common application you might have on your phone, nothing too complicated there, which is a good thing, really.

- Pictures Of Desi Arnaz Jr

- 3 Stelliums In Birth Chart

- Balcony Trooping The Colour

- Anderson Cooper Don Lemon

- Allison Holker Dwts Partners

Once you have the app on your phone, opening it up is the next step. To get registered and make your own personal Albert account, you'll be asked for some basic details. This usually includes your name, your email address, and then you'll pick out a secure password for yourself. That password is very important for keeping your information safe, so choose something that's hard for others to guess but easy for you to remember. It's a simple process, honestly, and it gets you ready to start managing your money.

Creating Your Digital Home for Finances - Albert Ezerzer Lucifer

Making your account with Albert is a bit like setting up a new home for all your financial information. It's a secure place where you can manage various aspects of your money life. This includes things like resetting your password if you ever forget it, keeping your account safe and sound, making updates to your personal profile details, and even handling how you get notifications from the app. It's all about giving you control over your financial data, which is, you know, pretty important in this day and age.

Beyond those basic setup steps, the app also provides ways to deal with things like external overdraft reimbursement policies, should that ever come up for you. And, for those who need it, there are ways to access your tax-related information through the application. So, it's pretty comprehensive in terms of what you can manage once you're inside your Albert account, offering a clear view of your financial picture. This kind of central hub is really what "Albert" is about, very different from anything "ezerzer lucifer" might suggest.

How Does Albert Help You Manage Your Money?

So, you might be asking, "How exactly does Albert help me keep my money in order?" Well, the application offers a good range of fundamental features designed to assist with everyday financial tasks. It covers the basics like budgeting, which is about planning how you'll spend your money, and managing your cash flow. It also includes options for instant savings, so you can quickly put money aside, and even some tools for investing, helping your money potentially grow over time. It's a pretty well-rounded set of tools, honestly.

Beyond those core functions, Albert also provides features for protecting your financial well-being and offers advice through a service they call "Genius." This "Genius" feature is there to answer your questions, giving you a bit of guidance when you need it. You can ask it about getting set up, or just general questions about managing your money. There's also a section for commonly asked questions, which can be really helpful if you have a quick query. It seems like they've thought about a lot of the typical things people need help with.

Putting Your Dollars to Work - Albert Ezerzer Lucifer

One of the really nice things Albert does is help you put your money to work for you, especially when it comes to saving. It can actually save money for you automatically, based on how much income you bring in and how you typically spend. This means you don't have to remember to move money around yourself; the app does some of that work for you, which is, you know, quite a convenience. It's a pretty smart way to build up your savings without really thinking about it too much.

Additionally, the app gives you the chance to earn an annual percentage yield, or APY, with high-yield savings options. This means the money you save can actually earn a bit more for you than it might in a regular savings account. And if you have specific things you're saving for, like a vacation or a down payment on something, you can create custom savings goals within the app. This helps you stay focused and track your progress towards those particular objectives. So, this "Albert" is truly about financial empowerment, not at all what you might associate with "ezerzer lucifer."

Exploring Albert's Financial Offerings

When you start looking at what Albert truly offers, you'll see it goes beyond just basic money tracking. It's about giving you a comprehensive view of your financial picture. The app helps you monitor your bills, so you know what's coming up and can avoid late payments. It also lets you track your cash flow, which means you can see exactly where your money is coming from and where it's going. This level of detail can be really eye-opening for many people, giving them a much clearer idea of their spending habits.

Being able to see where every single dollar is going is, frankly, a huge benefit. It helps you identify areas where you might be spending too much or places where you could cut back to save more. This kind of insight is quite valuable for anyone trying to get a better grip on their personal finances. It's about making informed choices, and Albert provides the information you need to do just that. It's a helpful guide, in a way, for your financial journey.

More Than Just Budgeting - The Albert Ezerzer Lucifer Difference

While budgeting is certainly a big part of what Albert does, it's important to understand that the application offers a lot more than just that. It’s a complete system designed to help you manage your money from various angles. From automated savings to investment opportunities and personalized advice, it tries to cover all the bases. This comprehensive approach is what sets it apart, giving users a more rounded experience than just a simple spreadsheet or a basic expense tracker.

The "difference" here, when we think about curious phrases like "albert ezerzer lucifer," is that this Albert is about clarity and control, not mystery or confusion. It aims to make your financial life more transparent and manageable. It's about putting the tools right into your hands so you can make smarter decisions about your money, which, you know, can lead to a lot less worry and a lot more peace of mind. That seems like a pretty good outcome, actually, for anyone trying to improve their financial situation.

What Does Albert Cost, and Is It a Good Value?

Naturally, when you're considering a financial tool, you're going to ask, "How much does Albert cost, and is it a good value for my money?" Well, the basic plan for Albert has a cost of $11.99 each month. This particular plan gives you access to a good number of benefits, though the full list of what's included might be longer than what's explicitly mentioned here. It's pretty typical for these kinds of services to have different levels of access based on what you pay.

A nice thing they offer is a chance to try Albert out for a full 30 days before you get charged anything. This is a pretty generous trial period, giving you plenty of time to explore the features and see if the app fits with your financial habits and needs. It's a good way to test the waters, so to speak, without having to commit financially right away. This trial period is available for both the basic plan and the other plans they offer.

Speaking of other plans, Albert's pricing can go up to $29.99 per month, depending on the specific plan you choose. So, there's a range of options, allowing you to pick what seems to work best for your budget and the features you want. Regardless of the plan you pick, you still get that 30-day trial period before any money is taken from your account. It's a way for them to show you what they can do, and for you to decide if it's the right fit. This flexibility is, you know, pretty helpful for potential users.

Is Albert a Bank? Clearing Up the Albert Ezerzer Lucifer Connection

Another very common question people have about financial apps like Albert is, "Is Albert actually a bank?" It's a really important question to ask, especially when you're dealing with your money. The clear answer is that Albert itself is not a bank. This distinction is quite important to understand. It's a technology company that provides financial management tools, but it doesn't hold your money in the same way a traditional bank would.

However, when it comes to the actual banking services, like holding your deposits or processing transactions, those are provided by a separate institution. In Albert's case, these banking services are supplied by Sutton Bank. And, it's worth noting, Sutton Bank is a member of the FDIC, which stands for the Federal Deposit Insurance Corporation. This means that your funds held through these services are insured, up to certain limits, which provides a layer of security for your money. So, while Albert helps you manage, a real bank is behind the actual money handling, which is a good thing to know, really, and clarifies any "ezerzer lucifer" type of mystery.

The Albert Community - Joining Millions of Users

One of the most compelling things about Albert is the sheer number of people who are already using it. You see, over ten million individuals have decided to join the Albert community today. That's a pretty substantial number, which, in a way, speaks to the app's usefulness and reliability. When so many people are putting their trust in a financial tool, it often means it's doing something right for them.

Being part of such a large user base can also be reassuring. It suggests that the app is well-tested, continually improved, and generally provides a good experience for a diverse group of people with different financial situations. It's like joining a big group of folks who are all working towards better money management, and that kind of collective participation can be quite motivating. So, it's not just an app; it's almost a shared experience for millions, which is pretty cool, actually.

Keeping Tabs on Your Spending with Albert

A big part of getting your finances in order is truly understanding where your money goes. Albert really shines in this area, helping you budget and track your spending with relative ease. It’s designed to give you a clear, straightforward picture of your financial outflows, which, you know, can sometimes be a bit of a mystery without the right tools.

The app makes it simple to monitor your bills, so you're always aware of what payments are coming up and when they're due. This helps you avoid late fees and keeps your accounts in good standing. Furthermore, it helps you track your cash flow, giving you a detailed view of money moving in and out of your accounts. You can literally see where every single dollar is going, which is incredibly helpful for making informed decisions about your financial habits. This level of insight is, honestly, what many people need to gain true control over their money.

- Aaron Rogers And Brittani

- Alexis Ren And Alan

- Shannen Doherty Funeral Service Date

- Black Friday Uggs Sale 2024

- Kylie Jenner And Chalamet

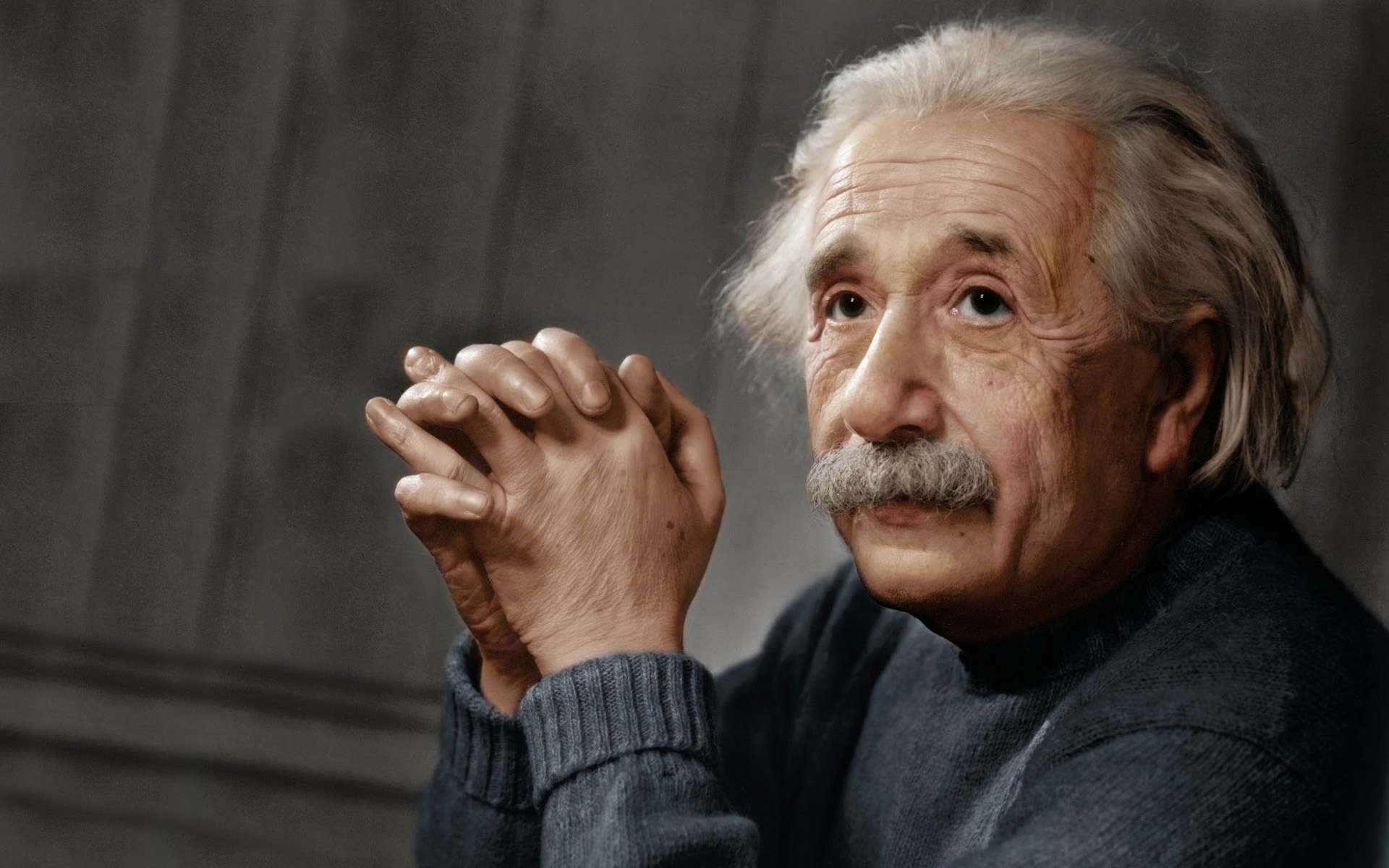

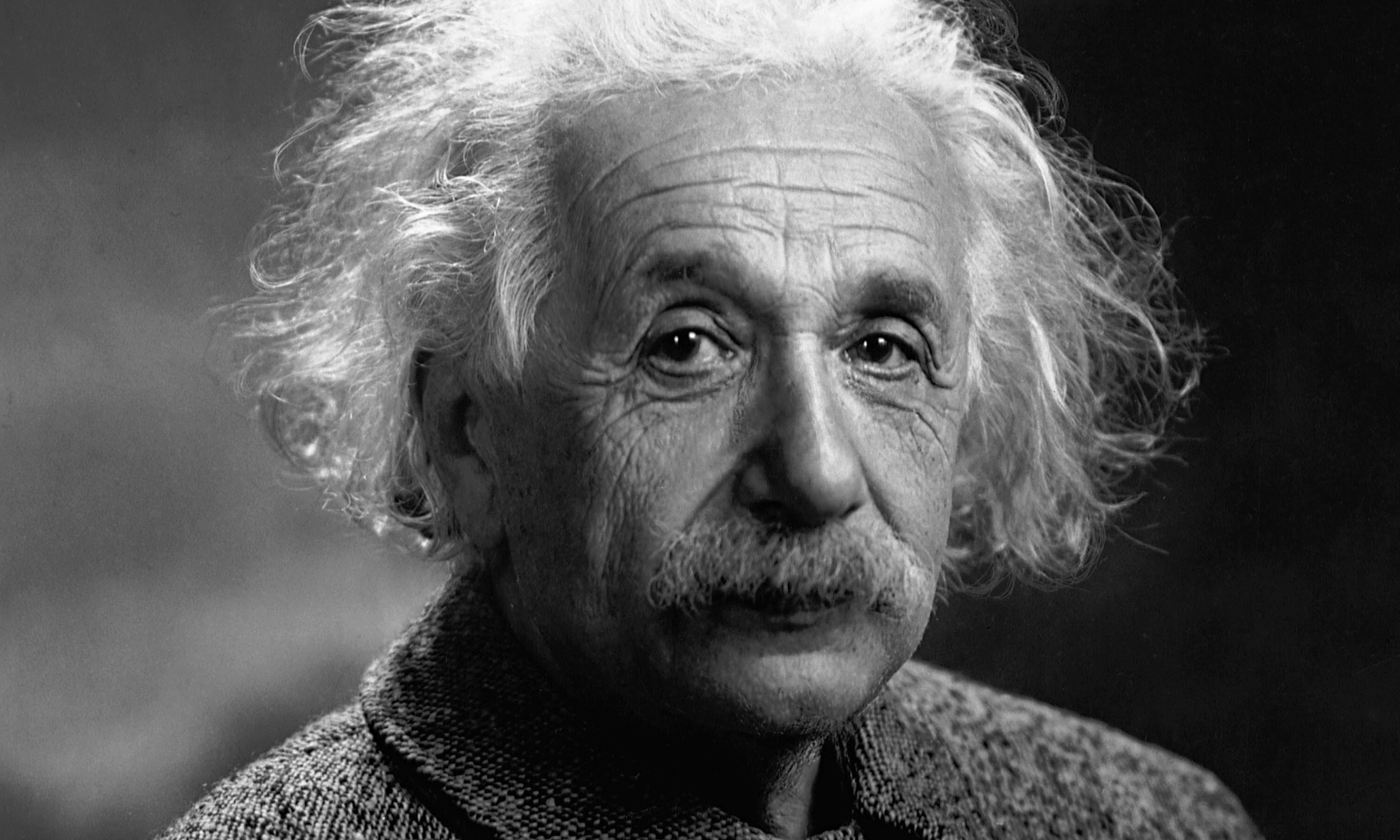

Albert Einstein Biography - Facts, Childhood, Family Life & Achievements

Albert Einstein Wallpapers Images Photos Pictures Backgrounds

Albert Einstein Wallpapers Images Photos Pictures Backgrounds